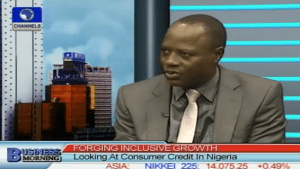

The CEO, Institute of Credit Administration, Dr. Chris Onalo, on Channels Television’s programme, Business Morning, highlighted some of the challenges which include low income, unreliable macroeconomic statistics, high interest rates and weak credit ratings systems for individuals and corporate institutions.

He said: “As the country seeks to forge inclusive growth and create jobs, it is important to put in place a robust system to encourage banks to lend to small businesses”.

Dr. Onalo believes this will go a long way in creating jobs and forging inclusive growth in the country.

In terms of consumer credit in SMEs, Dr. Onalo stated that therewere over 2 million SMEs in Nigeria that are looking to have access to credit which was not available to them.

“The level of credit to these SMEs is not strong enough to create jobs or to create wealth and that’s the fulcrum of any economy,” he noted.

He therefore advised the government to create more roads leading to infrastructural development to help the economy.