In a speech on Monday at a ceremony organised to launch the loan, the State governor, Dr. Emmanuel Uduaghan, said that the state’s decision was aimed at ensuring that everybody had access to the loan at a zero per cent interest rate.

The funds will be accessed by potential entrepreneurs in the state to boost the State’s economy.

It is one of the State government’s initiatives aimed at shifting the economy of the state away from its mainstay -crude oil – to agriculture and other sectors.

The governor of the state, Emmanuel Uduaghan stressed that “when small businesses are properly managed they will grow to big businesses”.

The loan facility is government’s responsiveness to the economic needs of the groups of entrepreneurs operating from different business environment in Delta State, a government official said.

The fund originally comes with a nine per cent interest rate and the micro credit payment is payable within 12 months while medium and small enterprises are payable within two to five years, depending on the project.

Affordable Finance For SMEs

But the governor said that the state government would pay the nine per cent interest on the 2 billion Naira, which is about 180 million Naira.

“We will pay the interest rate to ensure that it will get to the beneficiaries at zero per cent interest so that when they are making the returns, they do not have to pay with interest. This is one of the ways that we will support the programme to ensure that it will succeed,” he said .

Eighty per cent of the loan goes to micro business, 18 per cent goes to small and medium enterprises while two per cent goes to physically challenged persons including albinos.

Sixty per cent of the total sum will go to women.

The Central Bank of Nigeria had some months back, set aside 220 billion Naira for Small and Medium Enterprises development to be managed by State governments.

Out of the money, Delta State received about 2 billion Naira from the CBN funds.

About 500 million Naira was set aside for farmers, artisans, self-help groups and proactive entrepreneurs interested in setting up Micro Small and Medium Enterprises.

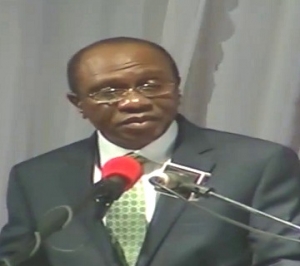

The CBN Governor, Mr Godwin Emefiele said that the loan would help solve the challenges of affordable finance for SMEs.

“Some analysts have estimated that this financing gap stands at 9.6 trillion Naira and in order to address this gap and unlock the potentials of Nigerian MSMEs the CBN initiated the 220 billion Naira fund as an innovative way of improving their access to finance at a single digit interest rate and shoring up their potentials for job creation and inclusive growth in Nigeria,” he said.

He said that the funds had been structured in a way that they could be accessed by persons who are in need of the funds most and not those who are simply privileged to occupy important positions in government.

The loans are being disbursed through commercial banks in different states.

According to him, Micro business owners can access a maximum of 500 thousand Naira per annum while Small and Medium Small Enterprises can access a maximum of 5 million Naira per annum.

The national flag-off of the disbursement of the funds was performed by President Goodluck Jonathan on August 19 in Abuja Nigeria’s capital.