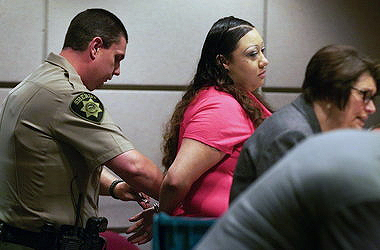

Remorseful Krystle Marie Reyes admitted she had collected $2.1 million in tax refund from the State of Oregon and so far the State has recovered close to $1.9 million from the stated amount. Resigning to fate, Marie said she will be taking responsibility for her actions.

According to report, Marie received a refund on her debit card and lavished $150,000, after which she reported lost or stolen card twice, an incident that aroused the suspicion of the Oregon Department of Revenue.

Working at a retirement/care homes, Marie was reported to be earning less than $15,000 per year in 2009 and 2010 but her way of living escalated as she went on spending spree as she bought with cash a 1999 Dodge Caravan which cost $1,800 and $851 on tires and wheels.

Other purchases Marie made included a queen-sized air mattress, a deep fryer, an air conditioner and a cream and grey floral rug. She bought a sofa and recliner with brown leather trim.

It was further reported that Marie filed in January an electronic tax return where she made a request for refund of $2.1 million which automated system of Turbo tax red-flagged. She also claimed she had earnings of more than $3 million.

Due to the request being red-flagged, the request tagged a potential fraud by the processing staff and managers, it was also set aside for review but was later shelved by a Revenue employee who overrode the flagged and the refund was issued.

The return was set aside for review by processing staff and managers for potential fraud. But “sometime later,” the affidavit said, a Revenue employee overrode the flagged payment and the refund was issued.

According to card policy, at least three employees are required to give verification to the override but no one responsible for reviewing the return opened the file to look at it or looked at the W-2 form Reyes filed, the affidavit stated.