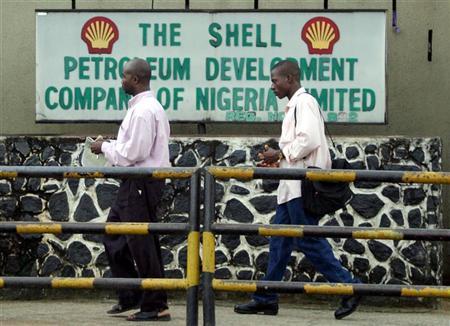

The Nigerian National Petroleum Corp (NNPC) and a local company bought an onshore oil block operated Royal Dutch Shell on Tuesday, NNPC said in a statement.

The OML 34 is amongst three onshore blocks that the Anglo-Dutch major has been trying to divest this year as part of a rejig of its portfolio in Nigeria.

NNPC said it and a company called ND Western will now run the oil block, saying in the statement that it is “a major milestone in the oil and gas sector”.

“The taking over of Oil Mining Lease (OML) 34 by the Nigerian National Petroleum Corporation and ND Western (is) part of measures to grow the in-country upstream capacity of the petroleum industry,” the statement said.

NNPC takes 55 percent and ND Western 45 percent of the block from Shell Petroleum Development Corporation, a Shell-run joint between NNPC, with 55 percent; Shell, with 30 percent; EPNL, with 10 percent; and Agip, with 5 percent.

Shell officials were not immediately available for comment.

Shell has been winding down some of its onshore operations to focus on offshore and deepwater drilling. The sales follow similar divestments over the past two years. The company said last month it was seeking buyers for OMLs 30, 34 and 40.

Shell’s onshore facilities are plagued with problems such as militancy and rampant oil theft, although the firm says such problems have not influenced its divestment plans.

Last year Shell sold its 30 percent stake in Nigerian onshore oil block OML 42 to local consortium Neconde Energy – which includes Nestoil Group, Aries E&P Company Limited, VP Global and Poland’s Kulczyk Oil Ventures – for $390 million.

In the same year, it divested its 30 percent stake in block OML 26 to First Hydrocarbon Nigeria (FHN), which is part-owned by Afren, for $98 million.

The Federal Government has a policy of boosting local participation in the oil industry, although critics say NNPC lacks the funds to invest sufficiently in its own assets.

The statement said the sale of the block “would give indigenous companies … the impetus to become an active player in the … oil and gas sector.”