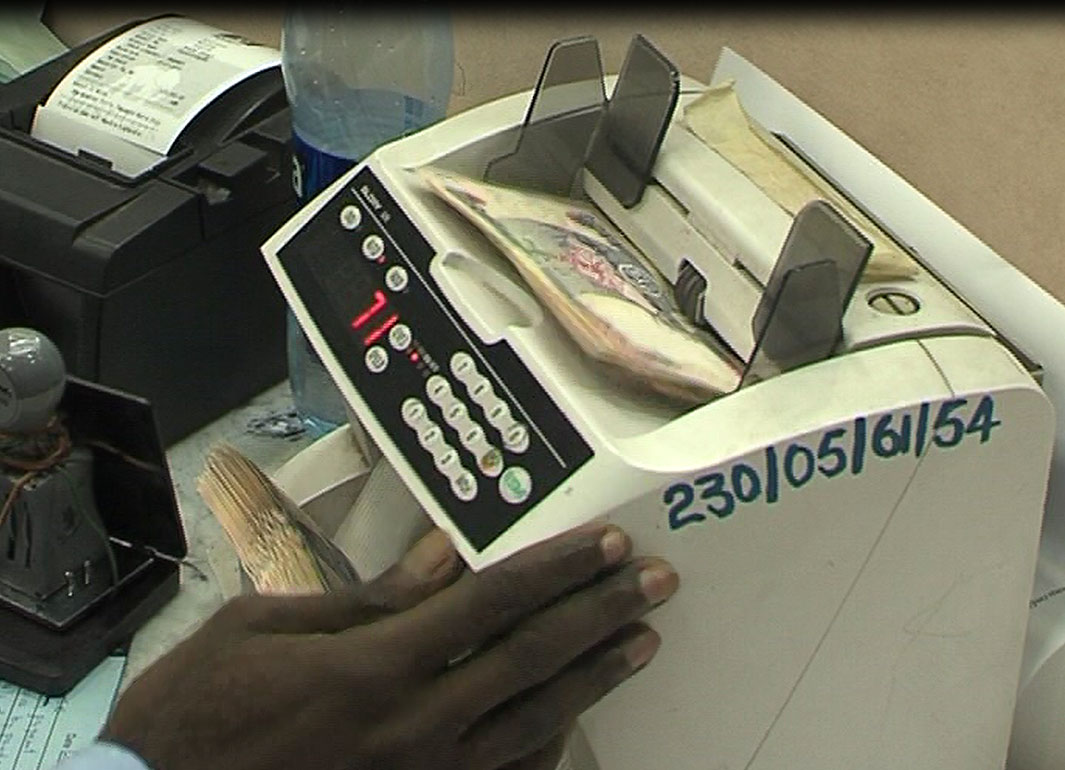

The naira firmed to a four week high against the U.S. dollar on Wednesday, a day after the central bank tightened liquidity in the banking system to support a currency which had fallen two percent since May.

The naira closed at N159.9 to the greenback, its strongest since June 19 and against Tuesday’s close of N161.9.

On Tuesday the naira fell 0.37 percent to its lowest level in three weeks against the U.S. dollar on the interbank market, as dealers were anticipating that the central bank would lower its trading band on the currency, which did not happen.

Dealers said local units of French oil firm Total and Italian oil company Eni sold a combined $80 million to the interbank market, helping support the naira.

The Central Bank of Nigeria on Tuesday hiked the cash reserve requirement for public sector deposits — which accounts for ten percent of banking sector deposits — by a surprise 50 percent to tighten liquidity and curb speculation on the currency.

The cash reserve for government deposits was previously 12 percent.

“Banks are reducing their long position on the dollar as the market digests the (central bank) decisions,” one dealer said.

The move also drove government bond yields higher on Wednesday, with yields rising more than 0.3 percentage points across maturities. The short-term most liquid 3-year note rose 0.52 percentage points to 13.93 percent.

Currency weakness has been a source of concern for a central bank worried about inflation, particularly damaging in a country of around 170 million people that imports around 80 percent of what it consumes.

At a currency auction on Wednesday, the central bank sold $300 million at 155.76 naira to the dollar at its twice-weekly auction, the same amount and rate that it sold at on Monday.

The regulator also sold treasury bills on Wednesday to mop up extra naira liquidity, dealers said, with foreign investors expected to participate due to the high yields seen from previous sales. Auction results are expected Thursday.

“We see the naira strengthening further as more oil companies sell dollars towards the month-end and banks cover short positions on the naira,” another dealer said.

The naira had been under pressure since May, despite the central bank selling $6.5 billion over two months at its currency auctions to support it. The currency was hit by a sell-off in bonds after the U.S. Federal Reserve signalled an end to the monetary stimulus that has supported emerging markets.