The federal government’s 10,000 mortgage scheme was inspired by President Goodluck Jonathan’s pledge to help tackle the country’s 17 million housing deficit.

On January 16, 2014, the President launched the Nigerian Mortgage Refinancing Company with a view to making mortgage accessible to Nigerians to enable them purchase and own their own homes.

To qualify as a beneficiary of a mortgage under the scheme, the prospective home owner must be pre-qualified to look for a home to buy, within the limits of the mortgage provided. Interested mortgage applicants are required to access a dedicated online portal for the scheme – www.housingfinance.gov.ng to go through a checklist of eligibility requirements to verify his or her status as a tax-paying Nigerian, who is a first time home buyer with a regular income.

Once eligibility of the applicant has been established, he would be directed to complete and submit a form requesting his personal and employer’s details, state of origin and residence as well as salary range.

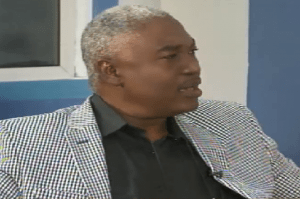

On this segment of Sunrise, a member of the Ministerial Committee on the project, Architect Ezekiel Nya-Etok, and the Chairman, Public Private Partnership, Real estate developers association of Nigeria, Sola Enitan, discussed the impact the project would have in spite of the 17 million housing deficit.