The CBN Governor, Mr Godwin Emefiele, on Tuesday read the communique announcing decisions reached at its September meeting in the nation’s capital, Abuja.

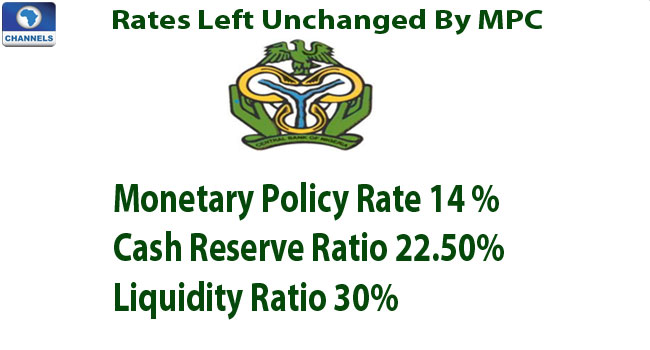

The committee agreed to keep the Monetary Policy Rate at 14 per cent, the Cash Reserve Ratio at 22.50 per cent and the Liquidity Ratio at 30 per cent.

Mr Emefiele explained that while challenges in the economy remain, monetary policy alone cannot boost growth. “Cutting interest rates is not advisable and the current stance will help to limit inflation,” he said.

“The committee assessed the relevant risks and concluded that the economy continued to face elevated risks on both price and output fronts.

“However, given its primary mandate and considering its limitations of its instruments with respect to output, the committee elected to retain the restrictive stance of policy invoked at its last meeting where it raised the Monetary Policy Rate from 12 to 14 per cent.

“Conscious of the need to allow this and other measures like the foreign exchange reforms to work truthfully, it decided to retain all monetary policy instrument at their current levels,” the apex bank boss stated.

He said that all 10 Monetary Policy Committee members voted to retain the MPR at 14 per cent, retain the CRR at 22.5 per cent, retain the Liquidity Ratio at 30 per cent and retain the asymmetric window at +200 and -500 basis points around the MPR.

The Minister of Finance had expected that the committee would lower key interest rates.

Speaking on Channels Television earlier in the day, Mrs Kemi Adeosun said that this would help stimulate the economy, especially as the government plans to boost the economy without increasing debt servicing costs.

At the last committee meeting in July, the benchmark Monetary Policy Rate was raised from 12 per cent, to 14 per cent, while the Cash Reserve Ratio and Liquidity Ratio were both retained, at 22.50 per cent and 30 per cent each.

Nigeria is currently in a recession after official data from the National Bureau of Statistic showed that its Gross Domestic Product (GDP) contracted by 2.06 percent in the second quarter, sending Africa’s biggest economy into a recession after a decline in the first quarter.