As Congo’s government solicited help from Western donors last month to contain a fast-deteriorating economic crisis, the chairman of the state mining company brought an unusual guest to the prime minister’s office.

It was Raymond O’Leary, a vice president from Russia’s second largest bank, state-owned VTB along with another VTB official.

They discussed a Eurobond to raise funds for the cash-strapped government.

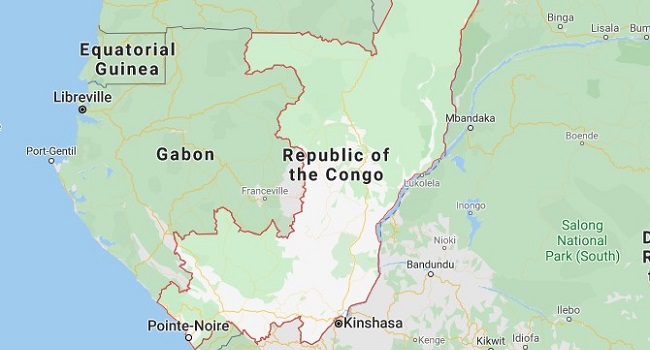

The outreach to a bank under U.S. sanctions and facing further scrutiny for its role in negotiating loans to Mozambique that led to millions of dollars going missing has underscored Democratic Republic of Congo’s perilous economic position.

It also suggests the possibility of an even harder turn away from the West by Congo than souring relations with traditional allies have indicated so far.

In a rare moment of bluntness in a speech last month, Deogratias Mutombo, governor of Congo’s Central Bank, said the economy is in very bad shape.

“It’s unacceptable that foreign revenues remain low, there has been no progress because we have been living in a situation where we have a shortage of foreign exchange. We thought that we would have enough by the second half of the year, but that has not been the case,” he said.

Congo is Africa’s top copper producer but its economic indicators are all blinking red.

Foreign reserves are down to three weeks of imports, annual inflation is expected to near 45 percent and the Congolese franc has already slid 30 percent this year – making it the world’s worst performing currency.

That is largely due to low commodity prices in recent years but analysts say there are other important contributors, including high deficits, rampant corruption and political uncertainty following President Joseph Kabila’s refusal to step down when his mandate expired in December.

The stakes are high. Violent anti-Kabila street protests and a surge in militia attacks and prison breaks since December have stoked fears the central African giant could slip back to the civil wars of the turn of the century that killed millions.

On the streets of the capital Kinshasa, many Congolese say they are “fed up” with the current economic situation.

“How can we live in such conditions, we cannot even take care of our children or provide them with healthcare or even pay school fees. Most people who live in Kinshasa rent their homes.

“Right now, I cannot even pay my rent. My landlord has not increased the rent but the Congolese francs has lost value. The dollar is too expensive. If you paid rent for 100 dollars now it will cost you 160 dollars. But our salary remains 63 dollars. So how can anyone buy dollars to pay for rent? There are no solutions to that,” said Kinshasa resident, Cathy.

“I used to buy my merchandise for 31 dollars and now it has gone up to about 44 dollars. If it continues, I will no longer be able to buy. We are doing what we can, but we are struggling, life is very difficult. Even finding food to eat has become difficult, let’s not even talk about school fees. How can you live like this in your country? It’s not right.” added Bumbulu, a street vendor.

In response to Congolese overtures, International Monetary Fund Managing Director, Christine Lagarde in June proposed sending a delegation to Congo in September to discuss possible financial aid yet warned any assistance package would probably require “a credible trajectory toward political stability”.

But a deal with VTB, which was blacklisted by the United States in 2014 over Moscow’s support for separatists in eastern Ukraine, would further undermine Congo’s chances with the IMF and other donors.

VTB, whose emerging markets-focused investment banking arm VTB Capital is active in Africa, said in a statement that it had given no commitment to lend to Congo and that it did not currently plan to.

The government of the Democratic Republic of Congo talked about issuing a roughly $1 billion Eurobond early last year, but it later abandoned the idea as the country’s economy deteriorated.

Analysts say appetite for the bond would be weak due to Congo’s political instability and economic frailty.

Jerome Sekana is an economist based in Kinshasa.

“Our economy is currently on its knees. We import most of our food. I think we spend around 1.5 billion dollars every year on importing food, which does not make sense given the country’s potential to produce food.

“We have over 80 hectares of arable land, but only 10 percent is used. If we cultivated more, then we wouldn’t need to import food that costs 1 billion dollars. That money could be going to other sectors and contributing towards running our economy,” said Sekana.

Kabila, in power since his father’s assassination in 2001, says the indefinite postponement of the election to succeed him is due to delays registering millions of voters.

But the political impasse and allegations of widespread human rights abuses by state security forces have left him increasingly isolated. Traditional allies the United States and the European Union have imposed sanctions on members of his inner circle and are reluctant to lend a hand.

Reuters