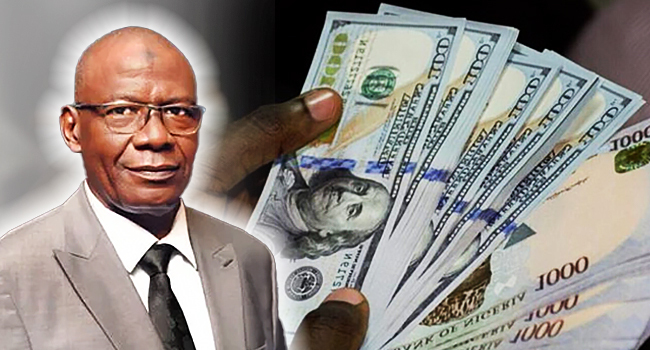

A potpourri of effusive accolades and slight skepticism have been poured on the Central Bank of Nigeria (CBN) in the past few days over the sudden appreciation of the Nigerian currency Naira against the United States’ Dollar. Commendably, the naira has appreciated against the dollar of late, gaining about 50%, from about N1,900/$ early February to about N1,000/$1 at the moment. The President of the Association of Bureau De Change Operators of Nigeria (ABCON), Aminu Gwadabe, believes that the local currency appreciated faster than expected. He opines that some policies of the apex bank have been responsible for the rebound of the local currency against the greenback. The BDC chief, who was guest on Channels Television’s Business Incorporated programme during the week, also believes that the emigration phenomenon known as ‘Japa’ can be formalised to boost Nigeria’s diaspora inflows and foreign reserves.

Enjoy the excerpts of the interview!

Let me start by asking how much is the naira trading for now against the dollar?

We buy at N980 and we sell at N1,200 as of now.

What would you say is responsible for this continuous appreciation of the naira from your perspective?

Well, it’s a long journey, it did not start today, and there are a combination of those factors that really helped in achieving this feat even though it happened faster than expected. I want to congratulate the management of the Central Bank. For the first time in history of Nigeria over the past 15 years, we have never seen where even the open market is lower than the CBN rate. So kudos to Central Bank and congratulations to Nigerians. There is calmness now and we have not been seeing speculation coming into the market which has been one of the albatross that is keeping the naira under pressure.

What you are seeing now is to show what happened before does not have any economic fundamental; it’s just a bubble and the bubble hsd been burst. This happened with some stringent and concerted policies, stress test policies that started from the unification of the market. It came with a mixture of feelings, a lot of disequilibrium. However, it has finally achieved its objective of convergence — all is to converge the exchange rate so that we can have a single market rate.

So, congratulations to the Presidency also. This is a journey from 1986 when we introduced the Structural Adjustment Programme. We have had many policies. So many factors have come together for the CBN policies for both the regulators and the operators.

Do you see this as being sustainable?

It has helped so far. The recent policy that disallows domiciliary deposits as collateral for loans made a lot of people to be dumping dollar. Of course, the achievement of Dangote (Refinery) now too, I think is also a very important factor. The pressure of dollar demand from oil companies is now disappearing. A lot of the policy put in place are working effectively.

Do you see this appreciation of the naira as sustainable?

Honestly speaking, I am sure the leadership of the Central Bank have their target. I’m not a regulator, I’m not the Minister of Finance so I will not give a target of what they are looking at but I’m sure they have a target and they are ready to achieve it. Yes, keeping it continuous is also a political will and I think the Presidency has the political will to ensure that that they meet that target. In fact, they already have a budgeted figure of what it is going to be so people can work around that.

There is a lot of confidence but I heard you when you are talking about the fixed market, how investors are getting confidence, we have seen how the Central Bank treasury bills have been over-subscribed and then we have seen how they have also corrected the flows of diaspora remittances. Now, they are having a chunk of diaspora remittances coming in because of so many policies of the Central Bank that try to calibrate how the influence should be coming in even though there’s a lot of gap that is not coming, that is still externalised in the diaspora window.

I’m happy the new guideline of the Central Bank for BDC operations in Nigeria did recognise Bureau de Change as agents of IMTs (International Money Transfers). That will bring in over $152 billion annually because there are a lot of operators over there that don’t have the last mile and lack of having that last mile, I mean somebody to do their transactions here, to terminate their transactions here. So, having BDCs that can now be terminating as their last-mile agent will generate nothing less than $10 to $15 billion annually.

Then, the government should also de-risk exports. The contribution of our non-oil export is not more than 4% to our GDP so we lack standard, we lack quality and this is a hanging fruit too. We need to to have a paradigm shift from depending only on 80% oil. In pre-independence, most of the project done in Nigeria are done with Agric proceeds so we should begin to think on how to go back to our pre-colonial areas so that we can diversify our income.

I heard the Minister of Finance talking about revenues increasing. Thank God revenues are increasing also the crude oil production is increasing, the last I read from 1.3 million barrel per day to 1.6 million barrel per day. So investors are also coming in there because there is also that of investment in the oil industry. We need bigger investments, complex investments that will come into that sector to harness the huge potential resources.

We should also look at youth empowerment. Our youths should be empowered, we can even start exporting skill, brains; we have a lot of them in arts and music. We have IT (Information Technology).

For instance in Bangladesh now, they export their people to Saudi Arabia, they do most of the jobs in Saudi Arabia. If you see the huge remittance, personal home remittances that Bangladeshis are sending from Saudi Arabia, you can’t believe it. Already, there is what is called Japa. Let us formalise Japa with skills, specification and standardisation. That will also help the youth, it will also help the country in terms of foreign reserves.

These are some of the things that I believe the government can put in place to sustain the achievement so far.