The Monetary Policy Committee has retained key lending rates at 11.5%.

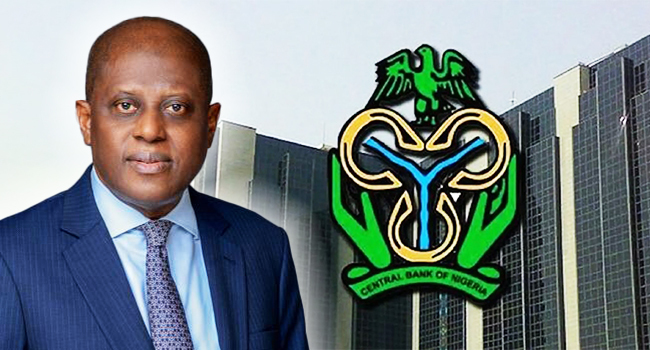

Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, announced this on Tuesday, saying it is part of efforts to boost the economy towards a sustainable recovery from the recession.

“Members voted in line with the most pressing need towards reversing the recession and achieving medium-term macro-economic stability.

“In view of the fore-going, the committee decided by a unanimous vote to retain all parameters,” Emefiele said.

“In summary, MPC voted 1, to retain MPR at 11.5%, (2), retain asymmetric corridor of +100 and -700 basis points around the MPR, (3) retain Cash Reserve Ratio at 27.5% and (4), retain liquidity ratio at 30%.”

This comes days after a new report released by the Nigeria Bureau of Statistics, showed that Nigeria had slipped into another recession after the economy shrank in the third quarter of this year.

Read Also: Again, Nigeria’s Economy Slips Into Recession

The same happened in 2016, making it the second recession in a space of four years.

The cumulative Gross Domestic Product (GDP) for the first nine months of 2020, therefore, stood at -2.48 per cent just as it recorded a -6.10 per cent in the second quarter.

According to Emefiele, the recession was anticipated and measures had been put in place to manage its impact.

Meanwhile, the Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, on Monday, said the country will exit recession by the first quarter of 2021.